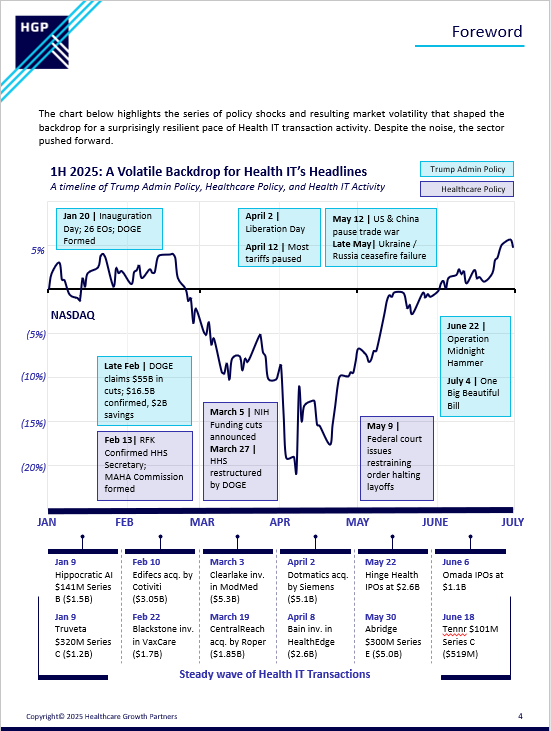

We entered 2025 with optimism, but a wave of policy shocks quickly turned a smooth start into one of the choppiest stretches we’ve seen in recent history. Despite the volatility, deals moved forward, valuations held strong, and Health IT showed resilience. Health IT has shaken off the overfunding and dislocation of the COVID era and is moving into a more rational, sustainable phase of innovation and growth. Looking ahead, a confluence of tailwinds is fueling renewed confidence and momentum, and from our seat, the window for deals has opened – so long as policy uncertainty doesn’t slam it shut.

Healthcare Growth Partners is excited to release its July 2025 Health IT Market Review, offering a detailed analysis of the trends and dynamics shaping the industry. From M&A valuations and funding trends to regulatory developments, this report explores the major forces poised to shape the Health IT landscape going forward.

To download the complete report, drop your name and email in the sign up form at the footer of this page or in the footer of www.hgp.com and a copy will be sent to you. As always, please let us know if you have any questions or comments.

Key Takeaways:

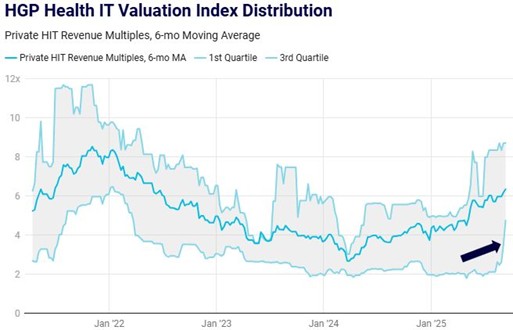

- Health IT Transaction Values Rally in 2025: Health IT M&A valuations accelerated sharply in Q2 2025, pushing the six-month rolling revenue multiple to 6.0x, up from 4.3x at the start of the year. Premium transactions reached as high as 9x revenue at the 75th percentile.

- Buyout Market Adjusts But Remains Active: Private equity buyout activity declined nearly 25% from 2024’s record pace but remained historically strong.

- Non-Buyout Investment Nears Pre-Pandemic Levels but Lags Recovery: Venture and growth equity activity fell short of expectations in 1H 2025. Total U.S. Health IT investments declined 18% year over year to 199 transactions, with investment value falling 22% to $5.1 billion.

- Macro Tailwinds Position 2H 2025 for Acceleration: Looking ahead, improved policy visibility, declining interest rates, stronger credit markets and the return of IPO activity are expected to drive increased M&A volume.

- Health IT Capital Markets Show Signs of Reopening: The first half of 2025 offered cautious optimism for health IT capital markets, highlighted by the successful IPOs of Hinge Health and Omada Health.