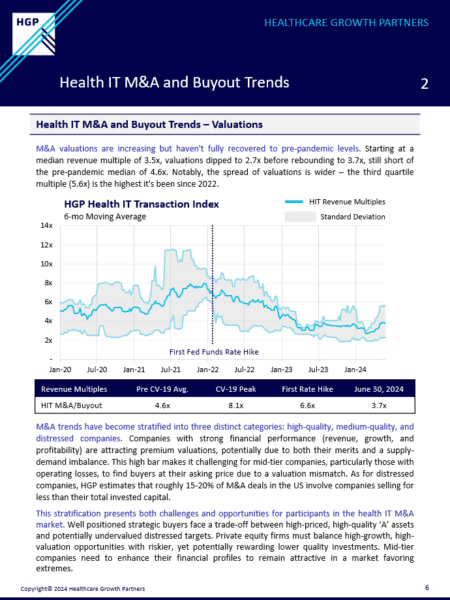

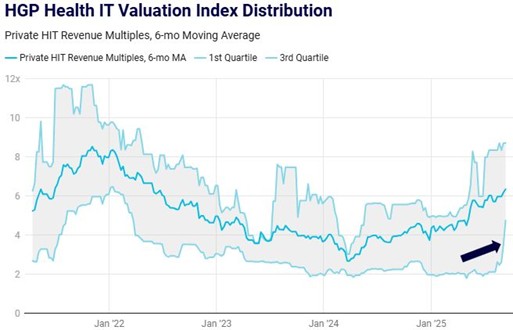

The Health IT market is sending conflicting signals in 2024. While M&A, buyout, and investment activity are surging, underlying valuations have not rebounded to pre-pandemic levels. This juxtaposition of activity and valuations creates a market in flux

To download the complete report, drop your name and email in the sign up form at the footer of this page or in the footer of www.hgp.com and a copy will be sent to you. As always, please let us know if you have any questions or comments.

Key Takeaways:

- M&A Valuations: In the first half of 2024, Health IT M&A valuations rebounded from a low of 2.7x to a median of 3.7x revenue. While this is an improvement, it falls short of the pre-pandemic median of 4.6x.

- Market Stratification: High-quality companies command premium valuations, mid-tier firms grapple with valuation mismatches, and distressed companies sell at discounts. HGP estimates roughly 15-20% of US M&A deals traded below invested capital.

- Buyout Surge: Buyout activity is on the rise, fueled by a recovery in the private credit market.

- Investment Trends: Health IT investment (excluding buyouts) is nearing pre-pandemic levels. AI investment soared to over $1 billion in 1H, favoring workflow tools over clinical capabilities by 7:1.

- Influencing Factors: Rebounding hospital margins, pharma tech demand, cybersecurity priorities, and a prolonged regulatory lag shape investment decisions.