2022 ushered in Act III of the market’s latest transitionary period: The Post-Inflation Era. To make sense of the crosscurrents from macroeconomic and inflation data, we leveraged our experience executing transactions, extensive network, and market analysis from our 16-year history advising and investing across the ever-evolving Health IT and Digital Health sectors to gather key market information.

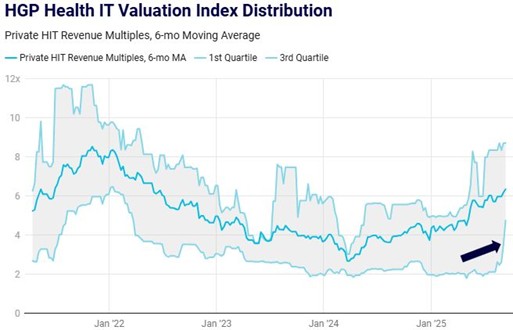

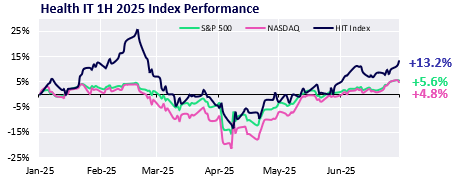

In this edition of the HGP Health IT Review, we delve into analytics about rising and falling valuation multiples over the Pre-COVID, Post-COVID, and Post-Inflation periods, metrics to understand the direction of M&A and investment activity, trends on the debt financing markets, and our observations of evolving transaction criteria in a changing market.

A strong appetite for investment and M&A persists, yet the appetite for risk is dramatically lower than a year ago. Any expectation for a return to Post-COVID euphoria is unrealistic, and as such, if the market settles at Pre-COVID levels, which is where it stands as of Q2 2022, we will consider this an excellent outcome. In some respects, the regression to historical norms is a healthy process for the market to return to patterns that are more predictable and sustainable. For now, given the falling trajectory as of Q2, we are monitoring the data closely in search for the floor and the idealistic “soft landing”.

The Semi-Annual Report includes the following:

- Health IT Valuations in the Post-Inflation Era

- Health IT Company Performance, as compared to Public Markets

- Health IT Market Trends

- Health IT M&A and Investment Activity

- Healthcare Capital Markets Performance and New Entrants

- Macroeconomic Trends

Download the complete report here. To stay in the loop, drop your name and email in the sign up form at the footer of this page or in the footer of www.hgp.com. As always, please let us know if you have any questions or comments.