Strategic M&A Activity Surges with Higher Quality Mix – Strategic M&A activity is surging, with US Health IT M&A volume up 71% since May 2023 (notably the same period following the collapse of SVB). In July, we estimated that around 20% of transactions involved companies trading below their invested capital, but the market now reflects a healthier transaction mix. The 6-month US annualized M&A volume now totals 428 compared to a pre-pandemic average of 320. Significant deals since July include RLDatix’s acquisition of SocialClimb, Datavant’s acquisition of Apixio, and mPulse’s acquisition of Zipari, among others. Notably, Hearst’s $2.5B acquisition of QGenda and CorroHealth’s $365M acquisition of Xtend Healthcare have further highlighted this upward trend.

Private Equity Investors View Trump More Favorably – HGP is conducting a survey of private equity sentiment in health IT, with full results expected soon. One question asks which presidential candidate would have a more positive impact on private equity, healthcare, and health IT investing (not necessarily their personal voting preference). Preliminary results from 71 responses show Trump favored for private equity by 80% to 20% specifically in terms of benefits to the private equity industry. Surprisingly, benefits to healthcare and health IT investing also favor Trump by 60% to 40%, which contrasts with the usual expectation that a Democratic candidate, advocating for increased government spending and regulation, would be seen as more beneficial to healthcare operators.

Fed Lowers Rates by 50 bps, Confident in Inflation Decline and Economic Strength – The Federal Reserve recently reduced its benchmark interest rate by 50 bps, lowering it to a range of 4.75% to 5%. This decision marks the first rate cut since 2020 and reflects the Fed’s confidence in the declining inflation rate, which decreased from a peak of 9.1% in mid-2022 to 2.5% in August 2024, nearing the Fed’s 2% target. Jerome Powell emphasized during the post-FOMC press conference that the 50 bps rate cut was not driven by concerns about economic weakness.

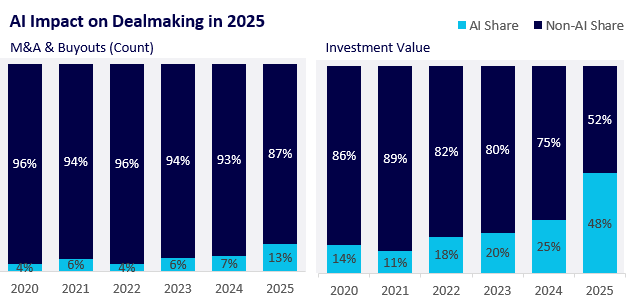

Health IT Buyout Activity on a Record Pace – Health IT buyout activity is set to reach unprecedented levels in 2024 – YTD buyout transactions increased to 66 versus 42 in the same period of 2023. Since July 1, 24 U.S. buyout transactions have been announced, with significant deals including GetWellNetwork (SAIGroup), Medicus IT (FFL Partners), Alight Professional Services (HIG Capital), AnewHealth (The Vistria Group), Nonstop Admin (LLR Partners), R1 RCM (TowerBrook), CuraLinc (Lightyear), The Chartis Group (Blackstone), Knowtion (Arsenal Capital), PAR Excellence (OceanSound), MediQuant (Revelstoke), Gebbs (EQT), VARIS and Swoop (New Mountain), PharmaForceIQ (Eir Partners), eClinical Solutions (GI Partners), and SureScripts (TPG Capital).

Particle Health Files Antitrust Suit Against Epic – Particle Health has filed an antitrust lawsuit against Epic Systems, accusing the EHR giant of using its market dominance to block competition in the payer platform space. The suit claims Epic cut off Particle’s access to critical patient data, hindering innovation in healthcare data exchange. Epic, which holds medical records for 94% of U.S. patients, defends its actions as compliant with HIPAA, arguing Particle was misusing patient data. The lawsuit seeks damages and an injunction against Epic’s practices.

An Ever-growing Backlog of Deals – Private equity and venture-backed companies are grappling with a growing backlog of liquidity-seeking deals as exit opportunities slow. This trend is evident in falling DPI (Distributions to Paid-In Capital) and lengthening hold periods. Many venture-backed companies have shifted focus from growth to cutting expenses, aiming for breakeven, while holding on to above-market expectations. A significant overhang of companies may need to accept the reality of their valuation and come to market in the coming months and years to clear this backlog.

Labor Day Sunshine – On a brighter note, many high-performing companies, which sat on the sidelines during the recent software downturn, are now re-entering the market. HGP expects strong deal activity between Labor Day and year-end. M&A valuations have also rebounded, nearing levels not seen since the pandemic, and we are optimistic that the next wave will generate both liquidity and attractive investment opportunities.