As we enter the final quarter of 2025, cautious optimism has given way to clear momentum. With both quality and quantity accelerating and a flurry of activity in the upper-tier emerging, Health IT is positioned for a robust close to 2025 and a strong start to 2026.

Market Ramps Across All Segments: Health IT activity is accelerating meaningfully into Q4, with strong momentum at both the high and low ends of the market. A steady pace of smaller transactions throughout 2025 is now being joined by headline-making strategic and private equity–backed deals – IPOs, major buyouts, and mid-market M&A all contributing to one of the busiest stretches in recent years.

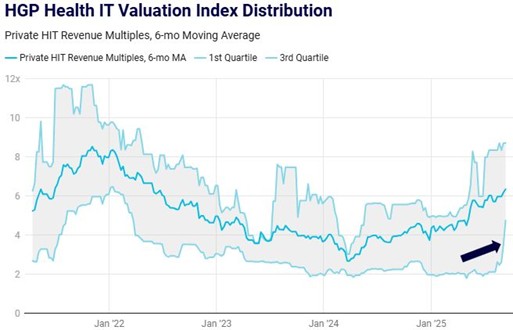

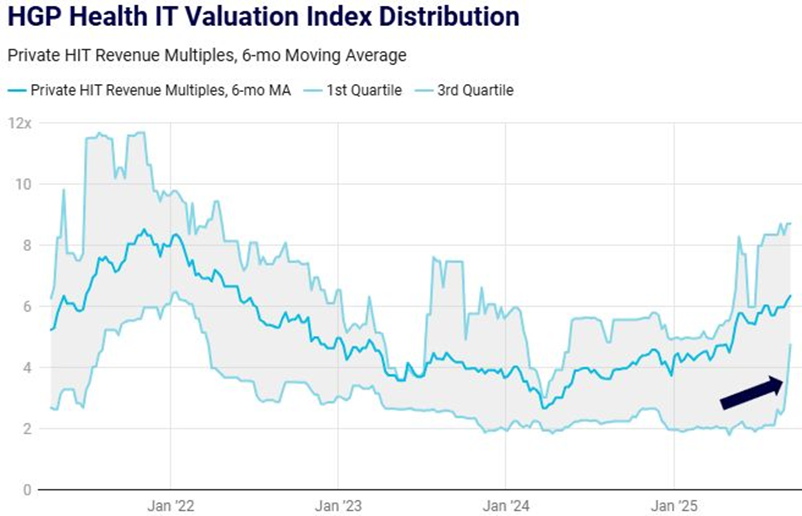

Health IT Multiples Surge: Revenue multiples have climbed over 50% year-to-date, rising from an average of ~4x at the start of 2025 to more than 6x by the end of Q3. Top-quartile valuations are approaching COVID-era peaks, propelled by large, strategic deals (Iodine/Waystar, Aetion/Datavant) and high-flying AI assets (Genoox/Qiagen, TrueLark/Weave).

Quality Rebounds at the Lower End: Distressed-driven activity is receding – lower quartile multiples have rebounded from ~2x to ~4x, signaling renewed health and stability across the broader market.

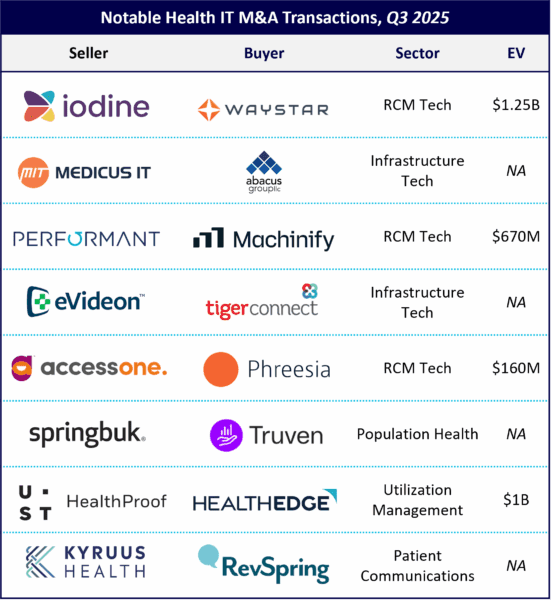

Health IT M&A Activity Accelerates Through Q3, Led by the Upper-End: M&A volume reached 111 U.S. transactions in Q3, up from 100 in Q2 and 93 in Q1, tracking to exceed 2024 totals by ~25%. Recent announcements including Press Ganey/Qualtrics, Kyruus/RevSpring, and Premier/Patient Square Capital reflect a market heating up at the upper end.

Deal Flow Converts from Record NDA Levels: Ontra processed 224 banker-led mandates in Q2, the highest since mid-2022. That surge in activity is now translating into closed transactions as deal flow strengthens and market confidence builds.

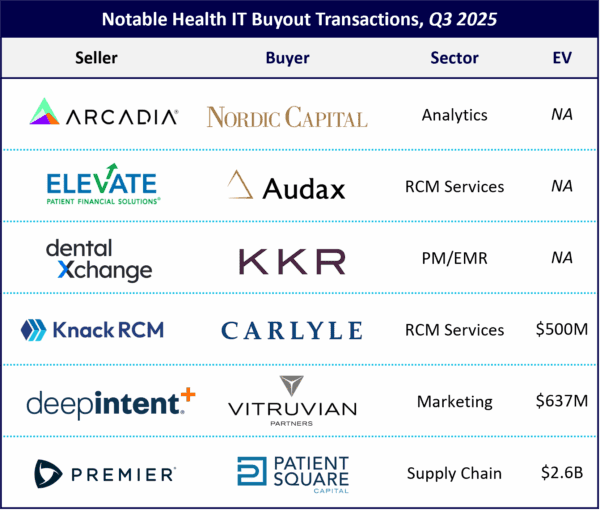

Buyout Market Maintains Steady Pace: Private equity buyout activity moderated slightly but continues at a historically strong clip of roughly 20 deals per quarter, driven by deployment pressure and stable credit conditions.

OBBBA and Government Shutdown Creates Noise Not Friction: Despite heightened discussions around the One Big Beautiful Bill and a federal shutdown driven in material part by disagreements on ACA tax credits and Medicaid cuts, most dealmakers continue to transact throughout the uncertainty.

Investment Activity Remains Tempered but Features Notable Standouts: Non-buyout investment activity continues to lag in its recovery, pacing to slightly exceed 2024 value by ~10% with $12.3B invested across 478 deals year-to-date. While mega-deals exceeding $100mm remain relatively muted compared to historical highs, seven transactions surpassing $250mm have closed YTD, outpacing 2019, 2022, 2023, and 2024 levels. Repeat financings also stand out as a hallmark of 2025’s market – Assort Health has completed three rounds this year and Abridge has raised $566mm across two back-to-back deals, underscoring conviction in proven AI-driven platforms despite a more selective funding environment.

Capital Markets Revive: The momentum established by Hinge Health and Omada has continued into the second half of the year, with Heartflow making its debut and another three deals in the hopper – MindMaze, Strava and most notably Zelis which is targeting a $17B enterprise value.

Revenue Cycle Management (“RCM”) Continues to See High Activity: Of the 27 verticals we track within Health IT, RCM continues to be the most active from an M&A / buyout perspective. Deal mix is roughly evenly split between technology and services. 2025 has seen a handful of $1B+ deals in this category (Elevate/Audax, Iodine/Waystar, AGS Health/Blackstone, Edifecs/Cotiviti, Access Healthcare/NMC).