Looking ahead, we’re moving into the second half of the year with a sense of renewed confidence, despite the volatility that defined the first.

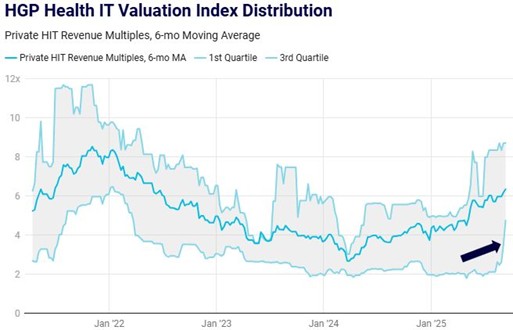

Health IT Transaction Valuations Rally in 2025: Health IT M&A valuations accelerated sharply in Q2 2025, pushing the six-month rolling revenue multiple to 6.0x, up from 4.3x at the start of the year. Premium transactions reached as high as 9x revenue at the 75th percentile.

Strong Activity Despite Volatility: M&A volume averaged 110 deals per quarter in the first half, up 29% from 2019 levels. Activity proved resilient despite political uncertainty and market swings.

Buyout Market Adjusts But Remains Active: Private equity buyout activity declined nearly 25% from 2024’s record pace but remained historically strong.

PE Deployment Pressure and Competitive Dynamics Drive Structuring: Private equity firms are under pressure to deploy a significant and aging capital overhang, contributing to competitive deal processes and elevated valuations for high-quality assets.

Macro Tailwinds Position 2H 2025 for Acceleration: Looking ahead, improved policy visibility, declining interest rates, stronger credit markets and the return of IPO activity are expected to drive increased M&A volume.

Non-Buyout Investment Nears Pre-Pandemic Levels but Lags Recovery: Venture and growth equity activity fell short of expectations in 1H 2025. Total U.S. Health IT investments declined 18% year over year to 199 transactions, with investment value falling 22% to $5.1 billion.

Fewer Large-Scale Deals, but Targeted AI Plays Advance: Large-scale investments pulled back in 1H 2025, with only 28 deals over $50 million totaling $2.9 billion, compared to 41 deals totaling $4.2 billion during 1H 2024. AI was critical in a material portion of these large-scale deals.

Health IT Capital Markets Show Signs of Reopening: The first half of 2025 offered cautious optimism for health IT capital markets, highlighted by the successful IPOs of Hinge Health and Omada Health.

Public Valuations Navigate Volatility and Display Resilience: HGP’s Health IT Index posted strong early gains. Notably, the period marked the first without any bankruptcies or take-privates, signaling a promising new chapter of stability and renewed momentum for the sector.

Policy Whiplash, Not External Shocks, Drove 2025’s Early Volatility: The year began with optimism as markets anticipated a pro-growth agenda under President Trump’s return. But that optimism was quickly tested by the administration’s executive orders, abrupt DOGE-driven spending cuts, and the surprise “Liberation Day” tariff proposal triggered sharp uncertainty.

Policy Clarity and Resilience Restore Market Momentum: After the Trump Administration walked back its most aggressive tariffs, markets began to reassess, and confidence returned.

Economic Signals Stabilize, Markets Rebound: Q1 GDP contracted by 0.5%, the first decline in over three years, largely due to a front-loaded import surge ahead of tariffs. But early Q2 indicators point to recovery. Despite ongoing geopolitical risks and fiscal uncertainty, the second half of 2025 appears positioned for continued and hopefully less volatile progress.