M&A and Buyout Highlights

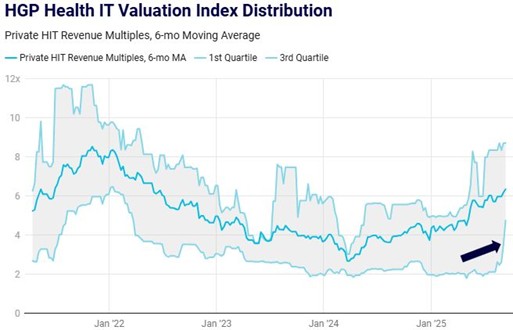

M&A valuations are increasing but haven’t fully recovered to pre-pandemic levels. M&A valuations in Health IT have been volatile in 1H 2024, rebounding from a low of 2.7x to a 3.7x median revenue multiple but short of the 4.6x pre-pandemic median. The valuation spread is widening, with top-tier companies commanding premium multiples (75th percentile is up to 5.6x revenue).

The Health IT M&A market is stratified: high-quality companies attract premium valuations, mid-tier companies face challenges due to a valuation mismatch, and distressed companies are selling at discounts. HGP estimates 15-20% of US M&A deals traded for less than invested capital in 1H 2024.

Buyout activity is surging in Health IT with 40 transactions in 1H 2024 despite higher financing costs, compared to 2020-2023 when the market saw 52-68 transactions annually.

The private credit market is rebounding, easing financing challenges for companies. Interest rates on floating-rate loans for private equity borrowers are decreasing as the bank loan market reopens and creates more competition from private credit lenders.

Health IT M&A volume is increasing with 106 US transactions in Q2 2024, exceeding pre-pandemic levels. However, there are concerns about declining deal quality due to a decrease in disclosed deal values. Only 13% of transactions in 1H 2024 disclosed values compared to 20-25% historically.

Public Market Highlights

Take-private deals signal dislocation in the public market. Recent acquisitions of public health IT companies at significant premiums (Augmedix: 163%, ShareCare: 87%, Model N: 23%, Everbridge: 62%) suggest a potential disconnect between public market valuations and the overall health IT market sentiment.

Public health IT lags broader markets. The HGP Health IT Index underperformed the broader market year-to-date, with a gain of only 3.9% compared to 14.5% for the S&P 500 and 18.1% for the NASDAQ, however the 3.9% nearly matches the 4.0% 1H performance of an “equal weighted” S&P 500.

The health IT IPO market is showing some revival with two notable debuts in the first half of 2024: Waystar and Tempus AI. Both debuted in June and are trading near their original issue prices.

Investment Highlights

Health IT investment (excluding buyout) is nearing pre-pandemic levels in total value despite lower deal volume. Median investment size jumped from $10M to $14M. Later-stage funding is challenged by high valuation expectations (watermarks). Series A funding is showing strength in deal values and valuations due to the AI-hype.

Health AI investment is soaring, but a focus on workflow may limit impact. Investment in AI-powered workflow tools outnumbers clinical AI tools by a 7:1 ratio.

Macro and Health IT Sector Highlights

The Fed is increasing EOY 2024 rate expectations. In contrast to the 3.5-4.5% expectations at the start of 2024, the target Fed Funds Rate for EOY is now projected to be around 5%. This upward revision reflects the persistence of inflation. However, recent data showing both lower inflation and higher unemployment offer more confidence in rate cuts.

The S&P 500 surged 15% this year, fueled by a 35% rally since October’s low, driven primarily by a handful of large-cap tech stocks. The Magnificent Seven, collectively account for 35% of the market cap weighted index, creating an unprecedented level of concentration. This lopsided market is evident in the stark contrast to the equally weighted S&P 500, which offers a more balanced view and is up only 4.1% in 1H 2024.

Hospital margins are rebounding. Kaufman Hall’s monthly operating margin index reached 3.8% in May 2024, a significant improvement compared to the 1-2% range seen in 2023. This indicates better financial health for hospitals, providing much needed support to the vendors that serve them.

Demand for pharma technology solutions is surging, driving up valuations in the sector. Life sciences tech M&A is at the highest rate seen in years.

Cybersecurity concerns are high. The recent attack on Change Healthcare, which is estimated to cost UnitedHealth Group $2.5 billion, has heightened the focus on cybersecurity within the healthcare industry.

A regulatory lag is hindering growth. The health IT market underwent a period of significant regulatory change over the past 15 years, driven by landmark legislation like HITECH, Meaningful Use, HIPAA Omnibus, FDA amendments, 21st Century Cures, and Interoperability standards. However, the sector is missing these growth catalysts due to the recent slowdown in major regulatory developments.