M&A and Buyout

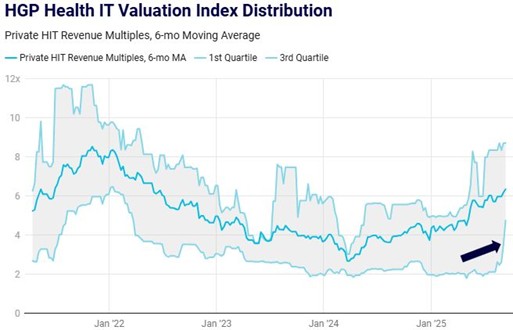

M&A Valuations Rebound: Health IT M&A valuations rebounded in 2024, nearing pre-pandemic levels. The 6-month moving average revenue multiple began the year at 4.0x, dipped to 3.0x in April, and climbed to 4.7x by November before closing the year at 4.3x. High-quality transactions gained prominence, signaling improved deal quality as the market also works through overcapitalized companies.

M&A Volume Exceeds Expectations: Peaking at 440 in mid-2024, M&A deal volume settled to 390 annualized transactions as of January 2025, surpassing the pre-pandemic average of 320 deals per year. This robust activity reflects heightened market engagement despite lingering challenges in certain subsectors.

Buyout Activity Surges: Buyout activity reached a record 86 transactions in 2024, surpassing the previous high of 83 in 2019. Private equity sponsors capitalized on reduced activity from strategic acquirers, leveraging opportunities in recapitalization deals and maintaining resilience through broader market fluctuations. EBITDA multiples remained stable, with larger transactions fetching premiums above 15 – 20x+ EBITDA in competitive processes for enterprise transactions.

Diverse Transaction Dynamics: The market showcased a mix of transaction types, including high-revenue-multiple deals for top-tier companies and structured exits for distressed assets. Notable examples include growth SaaS targets trading at ~5 – 9x revenue and several heavily structured exits, highlighting complexities that sometimes obscure actual proceeds.

Investment

2024 Non-Buyout Investment Activity Recovering: Non-buyout investment activity rose in 2024, driven by increases in both early-stage (Seed to Series B) and later-stage investments compared to 2023. A modest rebound mid-year brought activity to approximately $10 billion as of January 2025, about 10% below pre-pandemic levels.

Investor Priorities Shift: The HGP PE Survey revealed shifting priorities among private equity investors. Venture capitalists ranked “Returning More Capital” as their top priority for 2025 (71%), compared to 45% of growth equity investors and 37% of buyout investors, who balanced capital returns with new deployments.

Focus on Profitability: Investors highlighted the renewed emphasis on profitability, particularly among buyout and growth equity funds. Many saw this as a return to discipline, though venture capitals expressed concerns about an overcorrection that may stifle growth opportunities.

Valuations and Sentiment: While valuations declined across new investments, survey respondents noted increased deal flow, particularly among buyout and growth equity funds. Health IT investing displayed polarization, with venture capitalists cautious and buyout investors bullish, reflecting diverging views on market resilience and long-term stability.

Public Market

IPO Market Revival: The U.S. IPO market showed signs of recovery with 176 debuts in 2024, including 4 Health IT IPOs in Q2, marking the highest quarterly activity since 2021. Notable IPOs included Waystar, which ended the year 70% above its debut price, and Tempus AI, which remained stable near its IPO valuation. However, reverse mergers like Nuvo faced challenges, with Nuvo filing for bankruptcy shortly after its merger. A cautious return of IPO activity, with various candidates for 2025, points to a possible positive inflection for Health IT.

Public Valuations Recover and Diverge: HGP’s Health IT Index showed a stark dichotomy in 2024, with standout performers like GeneDx (+2,685%) driving gains, while only 18 of 52 constituents delivered positive returns. Excluding GeneDx, the index was down 3% for the year, reflecting the impact of young companies, SPAC-driven volatility, and depressed valuations (median share price: $10.76, down ~60% from 2022). Health IT go-private activity was also subdued in 2024 compared to prior years.

Macro and Health IT Sector

Resilient Growth and Easing Monetary Policy: Economic activity demonstrated resilience in late 2024, with annualized GDP growth of 2.5%. Core inflation dropped to 3.2% by year-end, the lowest since 2021, and is expected to reach the Federal Reserve’s forecast of 2.6% in 2025. The Fed funds rate, which declined to 4.25% – 4.50% by year-end, is projected to decrease another 75 bps, supporting economic expansion and capital investment. Investor confidence was further buoyed by the incoming Trump administration’s pro-business platform, focused on tax reductions and regulatory relief.

Broadening Market Confidence: The financial markets reflected strong performance, with the S&P 500 rising 23% in 2024. Gains extended beyond large-cap tech stocks, with mid- and small-cap stocks contributing significantly to the rally. This improved market breadth underscores investor confidence in the pro-growth policy environment and the prospects for economic stability.

Trump Healthcare Policy and Leadership Outlook: The Trump administration is expected to reshape U.S. healthcare policy through targeted reforms. Key officials, including Robert F. Kennedy Jr. at HHS and Mehmet Oz at CMS, signal a focus on nutrition, preventive health measures, price transparency, and exploring a greater role for private-sector solutions in government-funded healthcare programs. Incremental changes to the Affordable Care Act, rather than sweeping reforms, are anticipated, with an emphasis on reducing inefficiencies and improving patient-centered care.