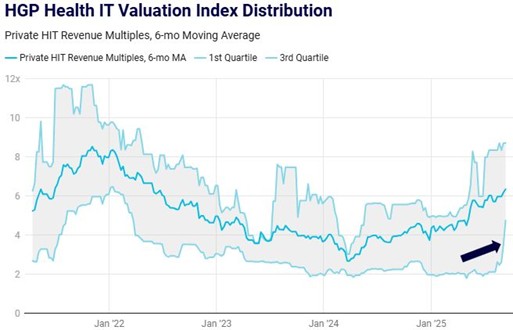

In conversations with PE, sponsors are losing transactions that are trading at 8-10x+ revenue multiples for strong Rule of 40 companies. However, these are occurring more in enterprise SaaS and less in Health IT, as possibly fewer Health IT companies are hitting Rule of 40 and for sure overall deal flow is down.

On a related topic, it feels like overall performance of the Health IT category has suffered due to more challenging sales environments particularly in the acute care market but also sales cycles elongating again with payers.

This dynamic makes health IT companies with strong bookings momentum and Rule of 40+ metrics stand out.

Money losing companies are still out of favor.

Many buyers are out of the market due to some combination of: over-leverage, digesting high value M&A during the market peak, or bookings challenges. Taken together, many buyers have tighter cash flow and are looking within to manage costs. For now, this shrinks the overall, active buyer universe.

At the same time, many buyers are coming into the market. We theorize this is due to: longer hold periods since the market for exits isn’t as strong right now which opens a window for M&A, the opportunity to acquire good companies that have come into hard times or have experienced a valuation reset, or wanting to get aggressive while competitors confront their own challenges. We view this as a very good market to be a buyer.

Seller expectations have reset faster than any time HGP has ever seen in our 16-year history. While not true for all sellers, of course, on the whole, sellers have largely detached themselves from the valuation expectations of post-COVID euphoria.

Sentiment feels more positive in 2023, as reflected in the public equity markets. Inflation numbers are coming down, while the economy feels like it’s holding up. Taken together, at this time it feels like sentiment is signaling a soft landing. But 2023 markets have felt a tension between the soft- and hard-landing scenarios, which may continue.