The Health IT market remains surprisingly resilient amid heightened volatility triggered by political and regulatory unpredictability under the new Trump Administration.

Initial optimism around deregulation and tax reform gave way to a more complicated reality, as a wave of executive orders, tariffs, DOGE cuts, and sweeping regulatory shifts introduced a level of unpredictability that has unsettled markets. Rather than providing clarity, these early moves have only deepened the sense that 2025 will be a year shaped by uncertainty.

Health IT M&A Continues to Outpace, But with Nuance

Against this backdrop, investors continue to have an appetite for risk. Health IT M&A saw 86 U.S. transactions in Q1 2025 – surpassing 75 in Q1 and 74 in Q4 of 2024. Buyout activity remains healthy with 19 transactions this quarter compared to 16 in Q1 2024 and 21 in Q4 2024.

Notable M&A and buyout deals, which reflect sustained buyer demand for scaled, strategically valuable platforms, include:

- Modernizing Medicine (Clearlake, $5.3B)

- Dotmatics (Siemens, $5.1B)

- Edifecs (Cotiviti, $3B)

- HealthEdge (Bain, $2.6B)

- Access Healthcare (New Mountain, $2B)

- CentalReach (Roper, $1.6B)

- Azara/i2i (Insight)

- Focura/Medialogix (Berkshire)

- GetixHealth (HIG)

- MDaudit (Bregal Sagemount)

Beneath the headline figures, however, the market tells a more nuanced story. A meaningful portion of M&A activity is driven by distressed or quasi-distressed situations – even if not labeled as such – implying the market is working through the funding overhang. At the same time, high-quality platforms continue to see strong demand and clear processes. The least predictable part of the market remains the midtier: moderate-quality assets, where valuation outcomes are difficult to handicap and revenue multiples vary widely. This dispersion in outcomes underscores the importance of positioning, process discipline, and precision in buyer selection.

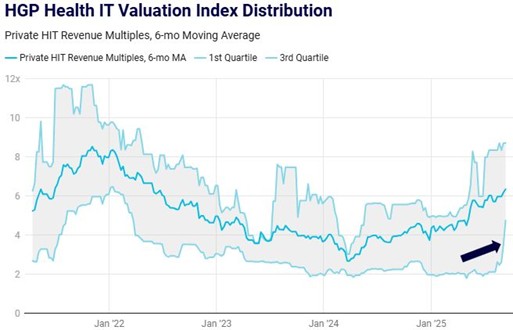

The median Health IT revenue multiple held near 4.5x YTD 2025, continuing its recovery from a low of 2.7x in early 2024. Total investment activity declined to 93 transactions in Q1 2025 from 114 a year prior, but deal value remained stable – averaging $2.4 billion per quarter over the past year.

More Policy Crosswinds than Tailwinds

Healthcare faced its own turbulence. Anticipated gains in Medicare Advantage were offset by policy uncertainty stemming from executive actions, DOGE impacts, and the leaked 64-page budget draft that points to an overhaul of HHS.

The leaked draft of the 2026 HHS budget, which ultimately requires congressional approval, offers a revealing look at the administration’s healthcare agenda. The plan cuts discretionary funding by 30%, from $117 billion to $80 billion, and proposes consolidating agencies while cementing many budget cuts, including within the NIH and FDA, and eliminating and consolidating cornerstone programs such as the Substance Abuse and Mental Health Services Administration (SAMHSA), Health Resources and Services Administration (HRSA), and the Agency for Healthcare Research and Quality (AHRQ). Keep in mind that the congressional approval process is likely to materially limit the ultimate changes.

Pitchbook Turns Bearish for Exits, and We Don’t Fully Agree

In late March, Pitchbook reversed its prior view, stating:

“Our December 2024 expectation—stronger exit opportunities paired with challenges in capital deployment due to elevated valuations—has reversed. Our updated view for 2025 anticipates tougher exit conditions given heightened macroeconomic risks, yet more attractive capital deployment prospects arising from potential market dislocations and increasingly motivated sellers.”

While we acknowledge that market conditions have tightened and the administration has underwhelmed on capital market expectations, we believe there’s still room for disciplined opportunity. The scale of activity may fall short of early hopes, but the underlying demand remains intact.

Overall, we advise remaining nimble in this market. Be prepared for it to move in either direction. One telling moment was the market’s 10% surge when tariff concerns were lifted – evidence of strong demand just beneath the surface. That kind of move could be further supported by the near-record levels of private equity dry powder. Now is a time to stay flexible and ready to adapt across a wide range of potential outcomes.