As we enter 2026, AI’s role in Health IT has become clearer and more grounded. Adoption accelerated meaningfully through 2025, but the market has begun to separate narrative from impact. Value is increasingly accruing to companies and sectors deploying AI against well-defined economic problems, particularly across workflow-intensive, data-heavy, and revenue-oriented functions. Importantly, having AI embedded today is not mission critical for every platform, but a credible roadmap to deploy AI at scale has become essential. In this environment, AI is less a source of standalone upside and more a prerequisite for maintaining relevance, shaping both investment priorities and M&A underwriting across Health IT.

Healthcare has traditionally been a late adopter to technology, but AI represents a notable exception. The combination of vast unstructured data sets and clear economic incentives, especially in billing, payments, and administrative workflows, has accelerated adoption across the sector. While many companies now position themselves as AI driven, valuation impact is accruing primarily to those using data in a meaningful, results oriented way. At the same time, the regulatory and compliance burden associated with deploying AI in healthcare is real and rising, which is likely to favor established players capable of navigating complexity and building durable competitive moats.

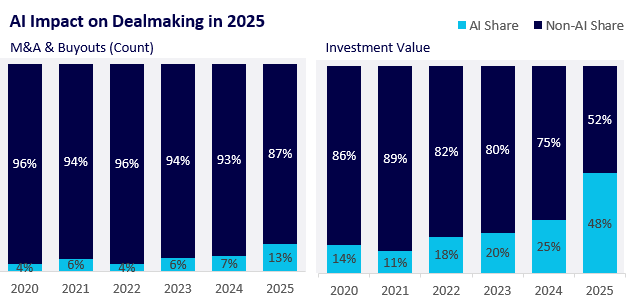

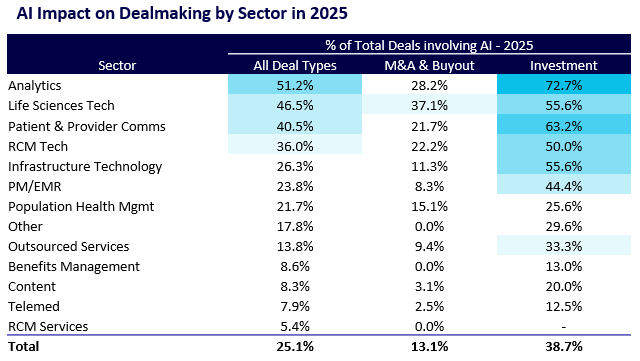

Despite AI’s prominence in market narratives, it is not yet the primary driver of most Health IT transactions. In M&A and buyout activity, only ~13% of deals are AI-native or AI-enabled companies. The majority of deals continue to center on mature, pre-AI or transitioning AI businesses with durable customer relationships, proven revenue models, and clear opportunities to apply AI to improve performance. In this environment, AI has shifted from an offensive differentiator to a defensive requirement. Companies without embedded AI capabilities, or a credible plan to deploy them, risk erosion of value, even if AI is not the core reason a buyer is underwriting the deal. The dynamic differs meaningfully in investment activity, where ~50% capital was allocated to AI-enabled companies.

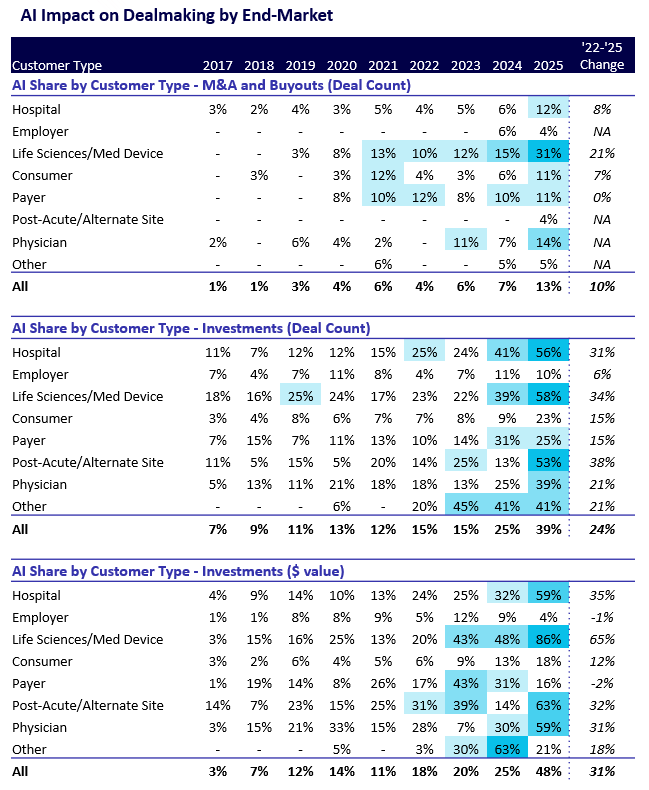

AI adoption also varies materially by end market. Life sciences and medical device companies have emerged as leaders, both in M&A volume and investment volume and value. This reflects stronger data density and access, clearer ownership and governance of data assets, and more direct ROI tied to R&D productivity, clinical trial optimization, and regulated workflows. Providers (across hospitals, physician practices, and post-acute care) are next in line, a trend driven by sustained margin pressure, rising labor costs, and the need to improve administrative efficiency at scale.

Across Health IT, AI actively remains highly concentrated in sectors with demonstrable ROI, including workflow automation, analytics, decision support, and revenue cycle technologies. Life sciences and medical device companies have emerged as leaders, both in M&A volume and investment volume and value. This reflects stronger data density and access, clearer ownership and governance of data assets, and more direct ROI tied to R&D productivity, clinical trial optimization, and regulated workflows. Providers (across hospitals, physician practices, and post-acute care) are next in line, a trend driven by sustained margin pressure, rising labor costs, and the need to improve administrative efficiency at scale.

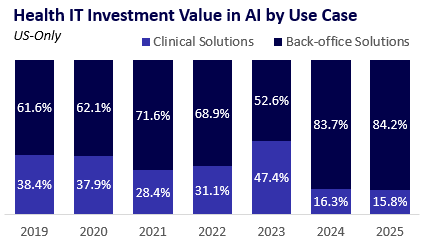

Investment by use case saw a meaningful shift away from clinical solutions with the emergence of LLMs. While investment continued to favor back-office and administrative solutions in 2025, momentum is beginning to move back toward clinical use cases, a shift already visible in the rapid adoption of OpenEvidence.

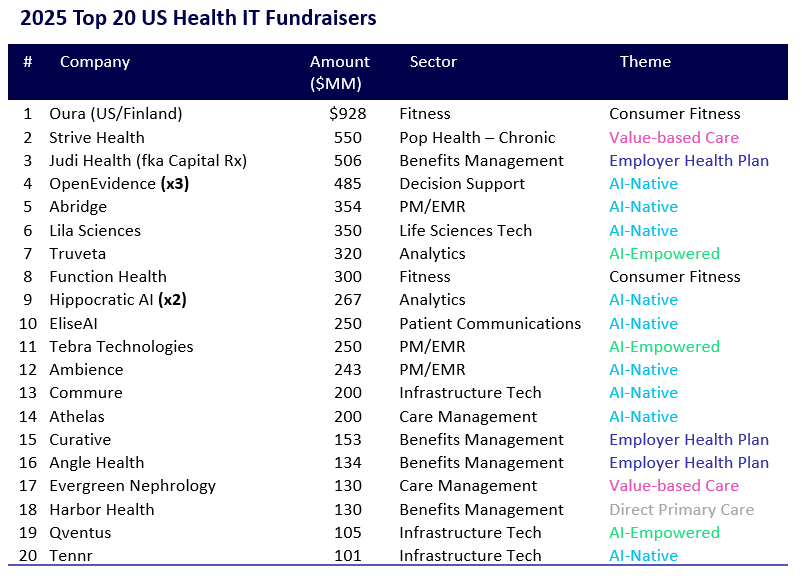

Artificial intelligence attracts significant, outsized investment but isn’t required across the board. Across the top 20 companies, both median and average capital raised increased meaningfully year-over-year – up 59% and 51%, respectively from 2024 – underscoring investor conviction in a few consolidated narratives. It’s well established that AI has the potential to reform the industry but, critically for operators, the question remains whether incumbents can successfully adapt AI by leveraging existing customer relationships, proprietary data, and infrastructure to avoid displacement. Investors are increasingly backing AI-native solutions that aim to disrupt well-positioned incumbents, with 9 of the top 20 US capital-raising companies either fully AI-native or appearing to have developed AI-native offerings. Notably, the companies flagged as “AI-empowered” deploy AI at varying depths across their platforms and some may reasonably be included in this cohort as well.

That said, the top 20 still reflect a broader set of durable healthcare investment themes. Consumer-driven care and patient empowerment are evident in Oura, Function, and Harbor Health. Judi, Curative, and Angle are rethinking employer-sponsored healthcare, introducing alternative models aimed at reducing costs below other options. Meanwhile, Strive Health and Evergreen Nephrology represent the continued momentum behind value-based care, a major focus of healthcare expenditure in the US.