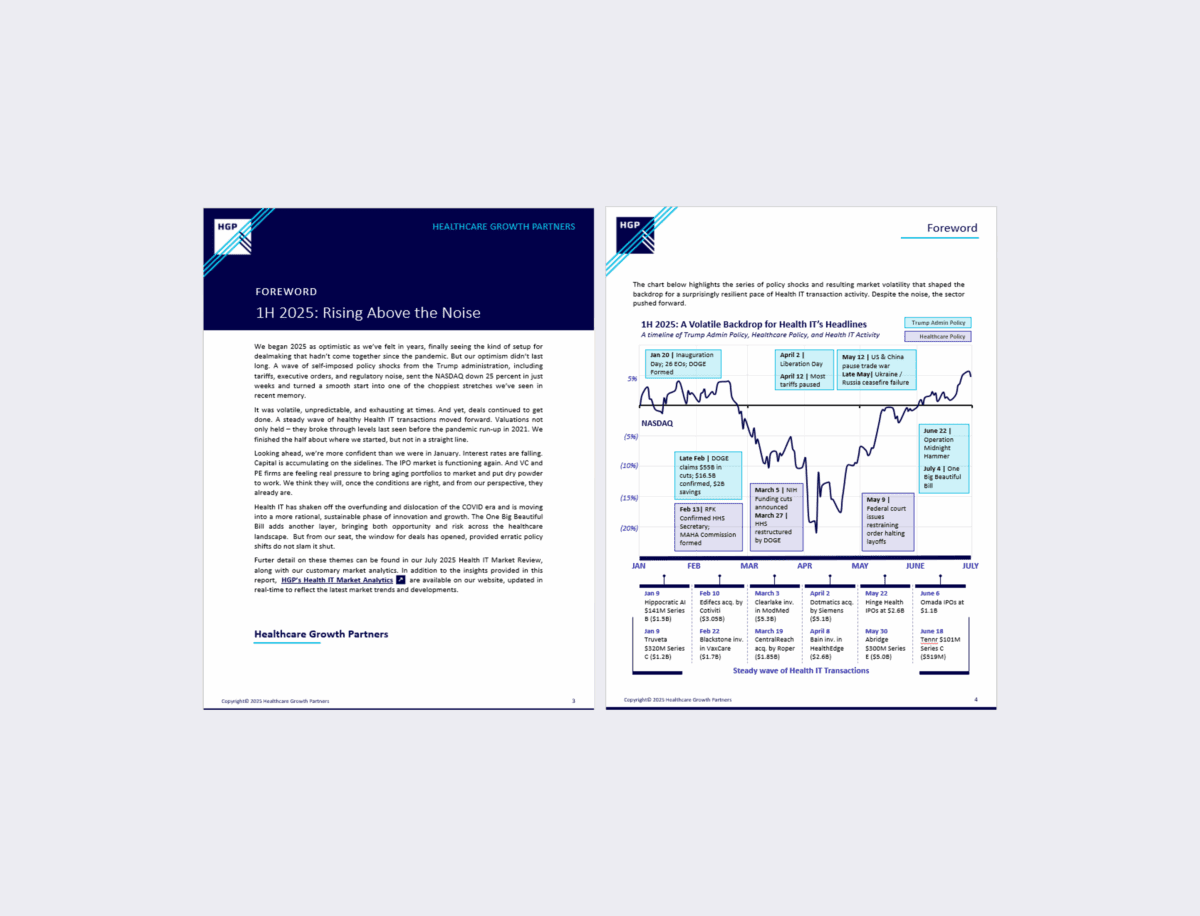

From armchair epidemiologists to armchair economists, never has society paid more attention to subject matter previously overlooked. With inflation persisting in the 6-6.5% range in 2022, market activity slowed considerably from 2021. From the same period a year ago, in 2H 2022 Health IT investment activity fell over 64% to $5.0 billion and M&A activity declined 35% to 139 transactions. Market participants are paying close attention to macroeconomic data looking for signs that the FOMC can tame inflation without breaking the economy. With Q4 Core CPI averaging an annual rate of 3.1%, inflation has rapidly fallen to levels that approach the FOMC’s target rate of 2.0%, but stubbornly held up by high wages. After a bearish 2022, the 2023 market is showing signs of confidence, and while it remains early to extrapolate these signals into a true upswing, the year ahead has the potential to restore confidence and the valuations and transaction activity that come with it.

In this edition of the HGP Health IT Annual Market Review, HGP explores the unfolding macroeconomic story that dictates the current and future state of capital market and Health IT investment and M&A activity. Leveraging macroeconomic, capital market and proprietary Health IT transaction data, the report synthesizes the information into a mosaic to help readers assess trends that can be leveraged for transaction and capital planning. Piecing together the data, public growth tech, broader public markets, private HIT markets, and the FOMC all experienced varying inflection points in response to the inflationary environment – notably growth tech led the market downturn, will it lead it out?

Download the complete report here. To stay in the loop, drop your name and email in the sign up form at the footer of this page or in the footer of www.hgp.com. As always, please let us know if you have any questions or comments.